Through both research and market oversight functions, the HPC’s work aims to enhance transparency around pharmaceutical drug costs and the factors and practices that contribute to them. Retail drug spending has become one of the fastest areas of spending growth in the Commonwealth, largely driven by escalating prices for the highest cost branded prescription drugs.

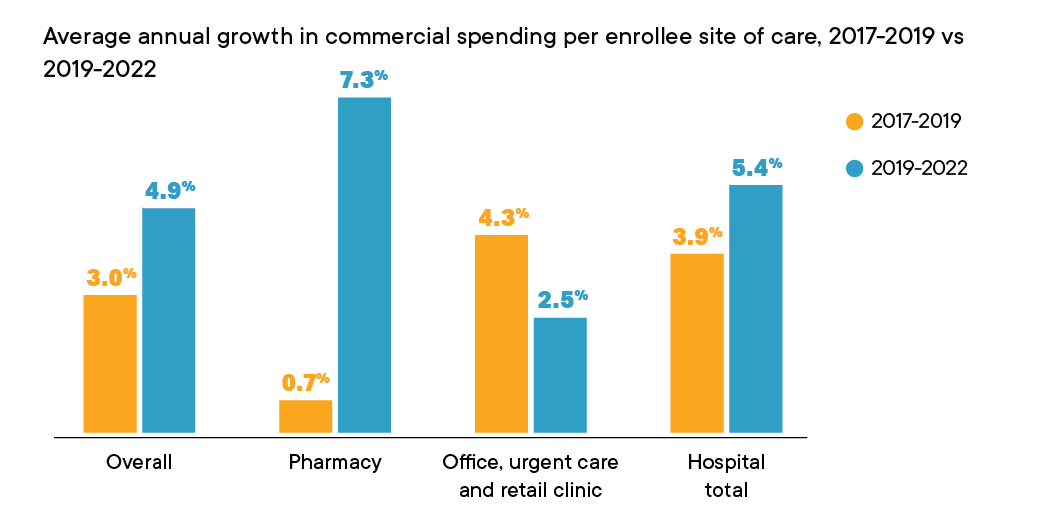

HPC research found that in Massachusetts, prescription drug spending grew more than 7% per year from 2019 to 2022 for those with private health insurance, which is 10 times faster than in previous years.

As drug spending continues to grow in Massachusetts, patients face barriers like high out-of-pocket costs when accessing critical medications. Average out-of-pocket spending for prescription drugs more than doubled for several common chronic conditions like arthritis, multiple sclerosis, and diabetes from 2017 to 2022.

As part of its research agenda, the HPC has also examined specific pricing practices for pharmaceutical drugs in Massachusetts, including pharmacy benefit manager (PBM) pricing models and health insurance payer policies for certain high-cost specialty drugs.

The HPC has a statutory authority to help manage pharmaceutical spending by conducting reviews of high-cost drugs referred to it by MassHealth, the Massachusetts Medicaid Program. Based on data and other information from pharmaceutical drug manufacturers and from MassHealth, the HPC may identify a proposed value for the drug and ultimately determine whether the manufacturer’s pricing of the drug is unreasonable or excessive in relation to the HPC’s proposed value for the drug.